Understanding the EUR/USD Exchange Rate and its Impact on Your Conversion

Converting 146 Euros to US dollars requires understanding the current EUR/USD exchange rate and the factors that influence its volatility. The exchange rate, essentially the price of one currency relative to another, constantly fluctuates due to global economic events, political developments, and market trading activity. This dynamic nature significantly impacts the final USD amount you receive. For example, a seemingly small shift in the exchange rate can lead to a considerable difference in the total conversion value. This article will guide you through navigating this complexity, showing you how to achieve the best possible conversion and minimize associated costs and risks. For more specific conversion examples, check out this EUR to USD converter.

146 EUR to USD Conversion in February 2025: A Practical Guide

In mid-February 2025, the EUR/USD exchange rate was approximately 1.04 USD per 1 EUR. However, this is just an average; the actual rate fluctuated throughout the month, ranging from approximately 1.0245 USD to 1.0494 USD per EUR. Compared to February 2024, where the rate was around 1.0842 USD per EUR, the Euro appears to have weakened slightly against the dollar over the past year. But remember, these are just snapshots; daily fluctuations are common.

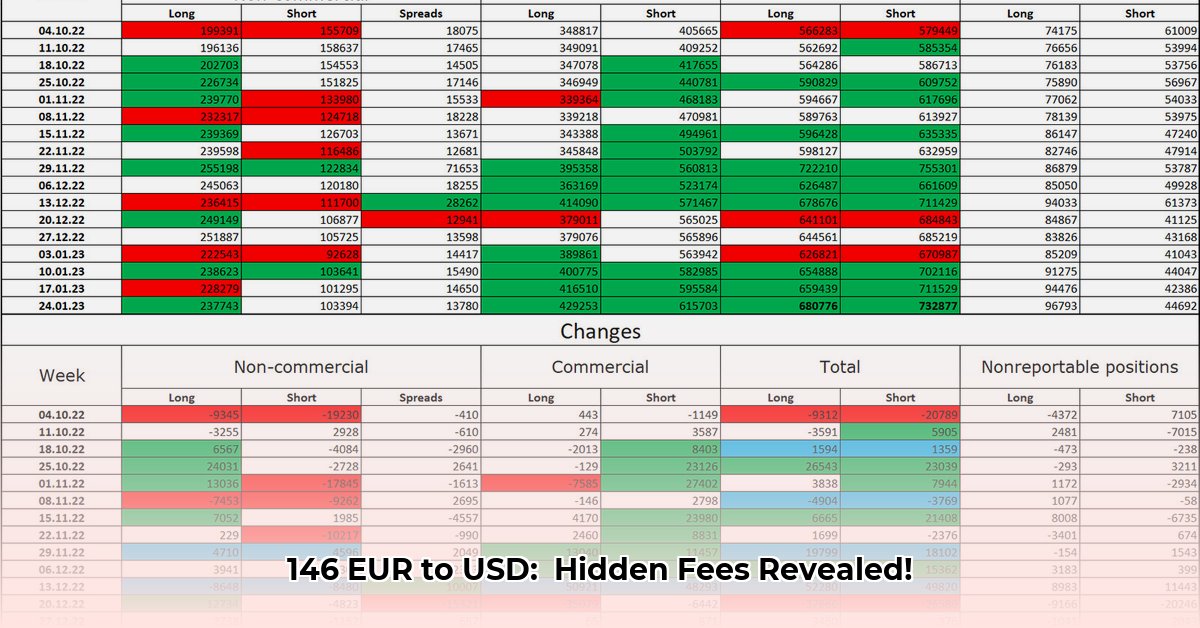

Visualizing the Fluctuations

(A chart visualizing the EUR/USD exchange rate fluctuations over 30 days, 90 days, and a year would be included here.)

This chart illustrates the volatility of exchange rates. Understanding this volatility is crucial for making informed decisions when converting larger sums of money.

Hidden Fees and Markups: Protecting Yourself from Unexpected Costs

Beyond the exchange rate itself, hidden fees and markups charged by banks and money transfer services can significantly reduce your final amount. These charges, often presented as transaction fees, exchange rate markups, or other miscellaneous deductions, can vary considerably among providers. Choosing a transparent service is crucial. Reputable services, like Wise, often operate with minimal markups, offering a fairer and more cost-effective transaction. Wouldn't you prefer to receive the most USD for your Euros?

Actionable Steps for Optimal Currency Conversion

To maximize your conversion and minimize costs, follow these practical steps:

- Monitor Exchange Rates: Regularly check reliable sources for the current EUR/USD rate. Understanding recent trends can help predict potential shifts.

- Compare Fees: Research various money transfer services and compare their fees, exchange rates, and overall costs before selecting a provider.

- Utilize Transparent Services: Favor services that openly display their fees and use the mid-market exchange rate (the average rate between two currencies), avoiding hidden markups commonly found with less transparent options.

- Consider Hedging (for Larger Sums): If converting large sums or facing significant exposure to exchange rate fluctuations, consider hedging strategies, such as forward contracts or options, to lock in a future exchange rate. Consulting a financial professional is wise if you are unsure about these financial instruments.

- Spread Transactions: If transferring a very sizable amount of money, spreading transactions over time could help mitigate potential risks associated with sudden exchange rate shifts.

Risk Assessment of EUR/USD Exchange Rate Volatility

The unpredictable nature of exchange rates introduces several risks:

- Volatility: The EUR/USD exchange rate can fluctuate significantly due to various factors, potentially resulting in lower-than-expected USD amounts.

- Hidden Costs: Opaque fees and markups can dramatically reduce your net gain.

- Geopolitical Events: Unexpected political or economic events can trigger sudden and unpredictable changes to the exchange rate.

Mitigating Exchange Rate Risk

Several strategies can help manage the risks:

- Diversification: Use multiple money transfer services to avoid overreliance on a single provider.

- Hedging: Secure a fixed exchange rate beforehand to insulate yourself against unexpected changes.

- Strategic Timing: Make transactions when the exchange rate favors your needs.

- Awareness: Staying informed about economic events and developments remains crucial in minimizing unintended consequences.

Conclusion: Informed Decisions for Successful Conversions

Converting 146 EUR to USD requires careful planning and awareness. By understanding the exchange rate's dynamics, avoiding hidden fees through transparency, and utilizing mitigation strategies, you can make informed decisions, securing the best possible conversion rate and limiting potential financial risks. Remember to consistently monitor the market, select reliable money transfer services carefully, and, for substantial transfers, consult with financial experts.